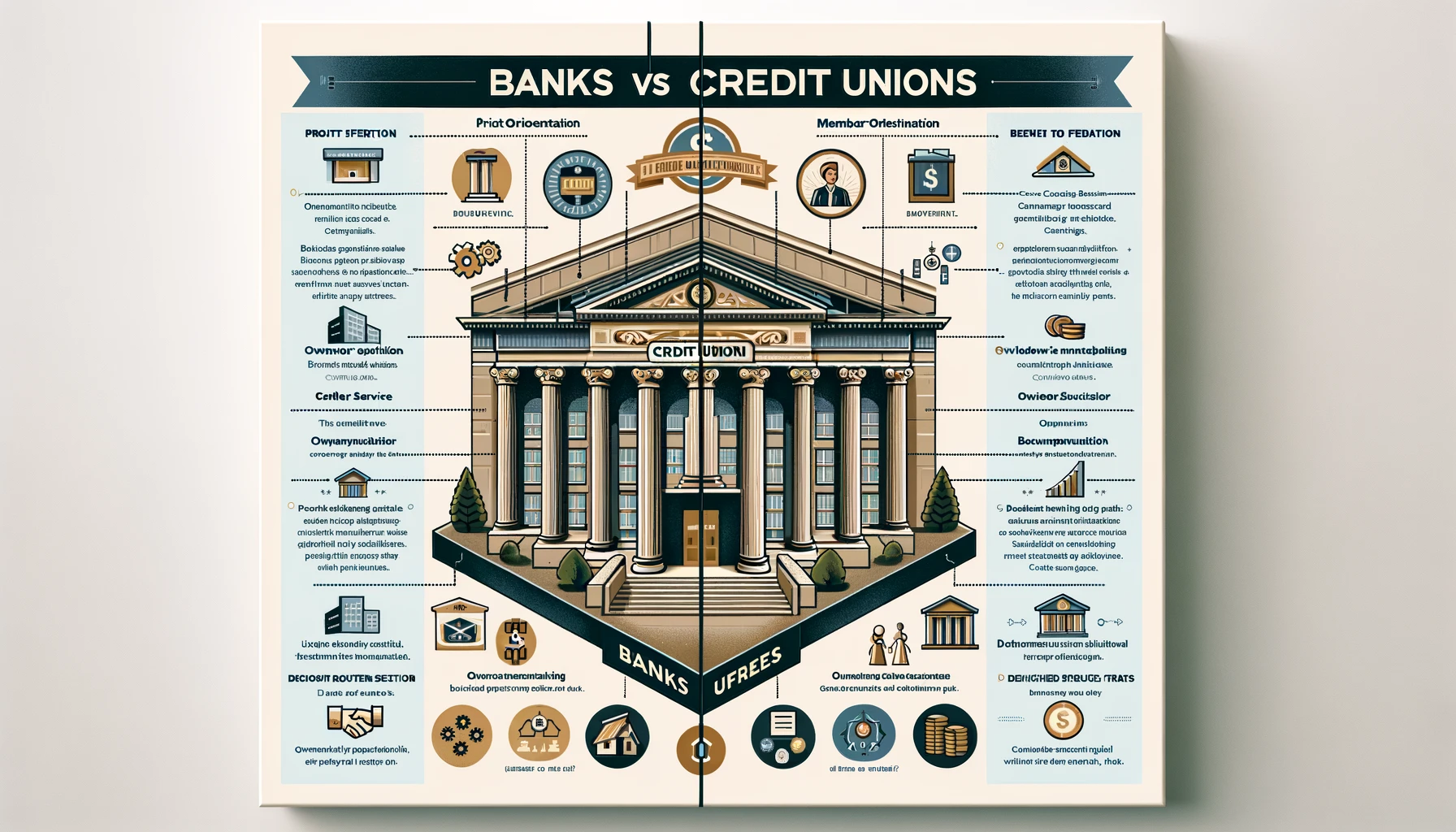

What’s the key differences between Banks and Credit Unions?

As most of you know (all 3 of you that read my blog) I work at Alkami Technology as the Sr. WordPress Developer.

In a nutshell Alkami provides desktop and mobile banking software for Banks and Credit Unions. So if you bank online (I mean who doesn’t) there is a good possibility you are using our software!

One of the many questions I get on a regular basis is “What’s the difference between Banks and Credit Unions?” …

So I figured I would write a blog about it because well I needed a blog topic anyway. So here it goes.

Banks and credit unions are both financial institutions that offer similar services, such as checking and savings accounts, loans, and credit cards. I am pretty sure you were fully aware of that but I needed to include it because google likes me to be thorough.

However, there are some key differences between the two that can impact which one is the better choice for you.

Unique Selling Proposition (USP) of Banks:

- Banks are for-profit institutions, meaning they are owned by shareholders and exist to make a profit. As a result, they often offer a wider range of products and services than credit unions, such as investment and wealth management options.

- Banks also tend to have more branches and ATMs, which can make it more convenient for customers to access their money.

- Banks are also more likely to have online and mobile banking options, which can make it easier to manage your account from anywhere.

Unique Selling Proposition (USP) of Credit Unions:

- Credit unions are non-profit organizations, meaning they are owned by their members and exist to serve the financial needs of those members.

- Credit unions often offer lower fees and better interest rates on loans, savings accounts, and credit cards than banks because they don’t need to make a profit.

- Credit unions also tend to have more personalized customer service, as they are more focused on serving the needs of their members rather than shareholders.

- Many credit unions also offer a wider range of services that are tailored to specific groups such as students, teachers, or government employees.

Banks may be a better choice if you are looking for a wide range of products and services, while credit unions may be a better choice if you are looking for lower fees and better interest rates.

I personally have always used a Credit Union when it comes to financing a car. As they almost always give the better rates.

In 2021, the average auto loan interest rate from a credit union was around 2% to 4% (4% -6% for banks) for new cars, and around 3% to 5% (6% – 8% for banks) for used cars. These rates tend to be lower than those offered by traditional banks because credit unions are non-profit organizations and do not need to make a profit like banks do.

Let’s wrap it up

In summary, banks and credit unions both offer similar services, but they have different business models.

Banks are for-profit institutions, which tend to offer a wider range of products and services than credit unions, but have higher fees and interest rates.

Credit unions are non-profit organizations that tend to offer lower fees and better interest rates, and focus on personalized customer service.

The choice of banking with a bank or a credit union depends on an individual’s preferences and financial needs.

Alkami’s Digital Banking Solutions: A Galaxy Apart from the Rest